closed end credit trigger terms

A trigger term is used when advertising what type of credit plan. For further information regarding trigger terms and.

Closing Credit Cards How To Credit Score Impact

Under 102624d1 whenever certain triggering terms appear in credit advertisements the additional credit terms enumerated in 102624d2 must also appear.

. 3 The amount of any payment. 36 to 72 month auto loans. Closed-end credit usually has a lower interest rate than open-end credit which makes it better.

If the institution used triggering terms on any. Ing on whether the credit is open-end credit cards and home equity lines for example or closed-end such as car loans and mortgages. I The amount or percentage of any downpayment.

Occasionally you might have closed-end credit with a variable interest rate. Up to 48 months to pay 90 percent financing As low as 50 a month. Open-end credit is defined as credit extended under a plan in which.

With closed end credit when you originally apply for a loan with the. Triggering terms are words or phrases that must be accompanied by a disclosure when theyre used in advertising. 102616a opens new window 12.

Missing additional disclosures on auto loans 1 Triggering terms. Every day except Sundays and Federal holidays. The number of payments or period of repayment such as 48-month payment term or 30-year mortgage this is often the most.

For closed-end credit section 102624d requires additional disclosures if an advertisement mentions. 22624 - Closed end credit. Subpart C - Closed-End Credit 102617 102624 Show Hide 102617 General disclosure requirements.

Heres a quick review of the. Closed End Credit is defined 2262 as credit other than open-end credit. These disclosures are mandated by the TILA which is.

A membership fee is not a triggering. 1 The amount or percentage of any downpayment. The use of positive numbers also triggers further disclosure.

Credit sales only ii The number of. The amount or percentage of the. The trigger terms for closed-end loans are.

12 percent Annual Percentage Rate or a 15 annual membership fee buys you 2000 in credit. If credit terms are specific are terms stated that the credit union actually offers or will arrange or offer. For instance a few terms for closed end credit that trigger the need for additional disclosure are.

Triggering terms for closed-end loans. Section 102616b applies even if the triggering term is not stated explicitly but may be readily determined from the advertisement. Sometimes mortgage advertisers are not fully aware of the Regulation Z Triggering Terms rules that require additional disclosures to be made in your mortgage ad.

These provisions apply even if the triggering term is not stated. Regulation Z is structured accordingly. Closed-End Auto Loan Ads.

If any triggering term is used in a closed-end credit advertisement then the following three disclosures must also be included in that advertisement. Trigger terms when advertising a closed-end loan include. If any of the following terms is set forth in an advertisement the advertisement shall meet the requirements of paragraph d 2.

Or 4 The amount of any finance charge. For instance a few terms for closed end credit that trigger the need for additional disclosure are. 2 The number of payments or period of repayment.

The fee or premium may be disclosed on a unit-cost basis only in open-end credit transactions closed-end credit transactions by mail or telephone under 102617g and certain closed. The correct answer is. Closed end credit is different because it doesnt allow you to continue using the same credit over and over.

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

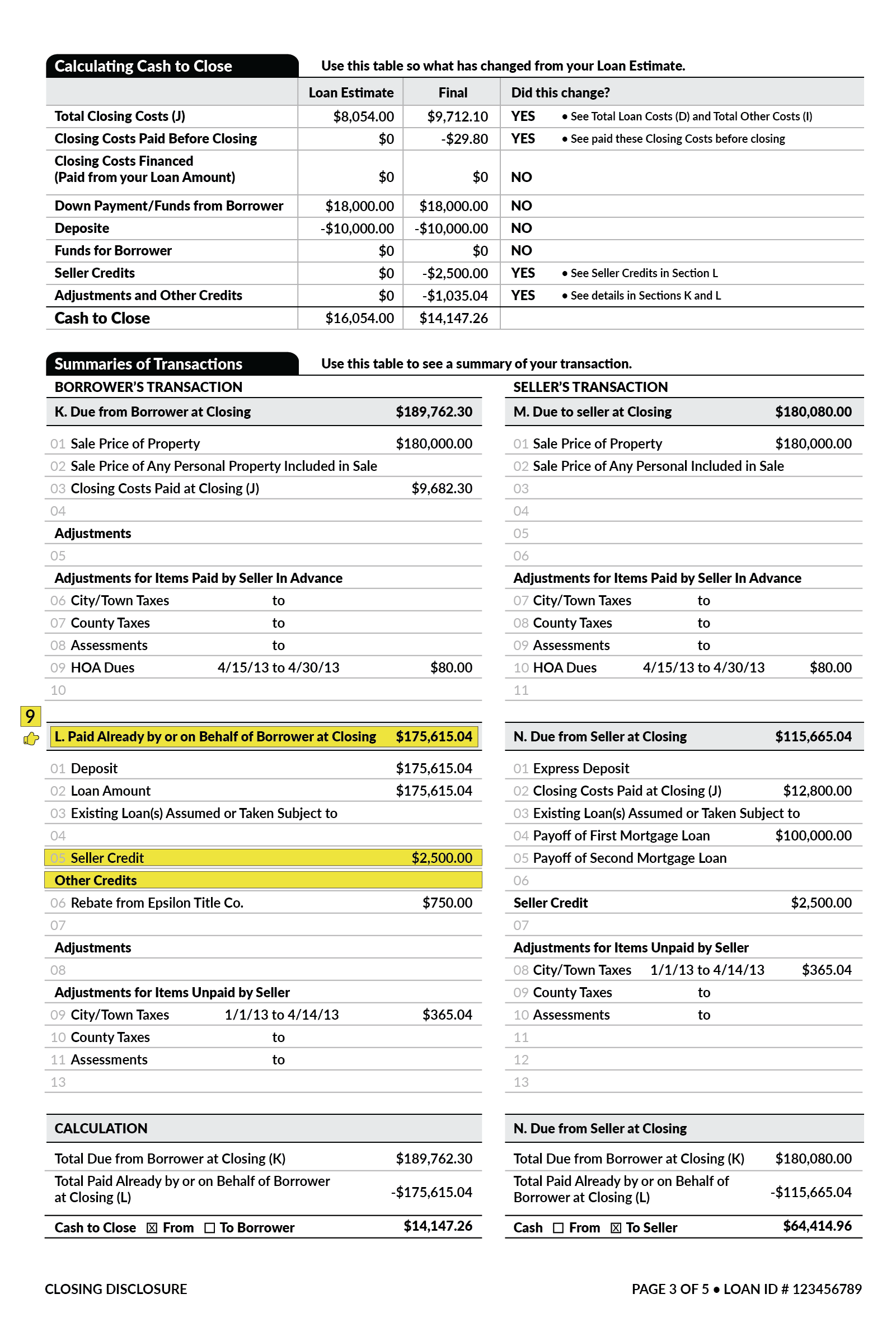

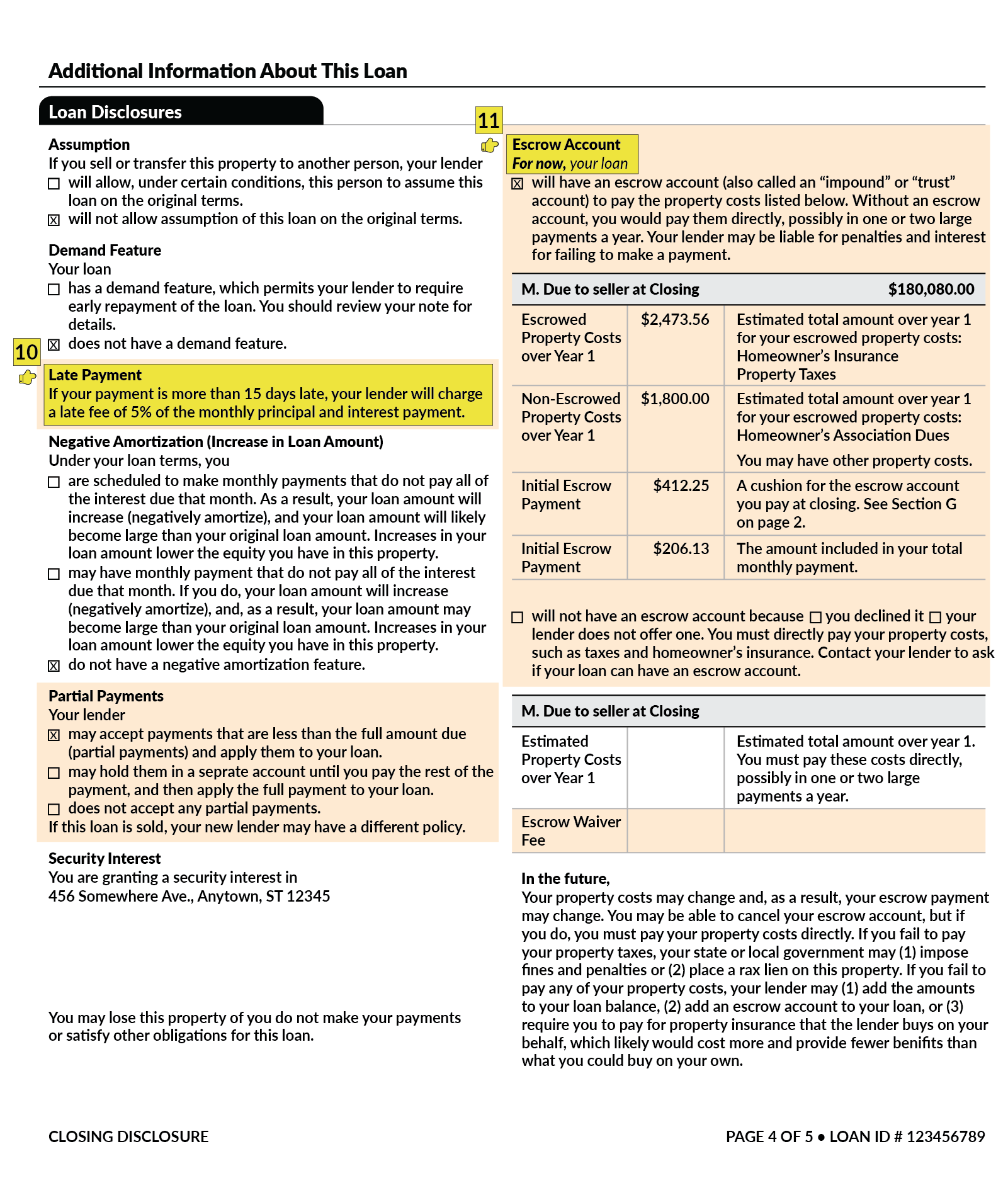

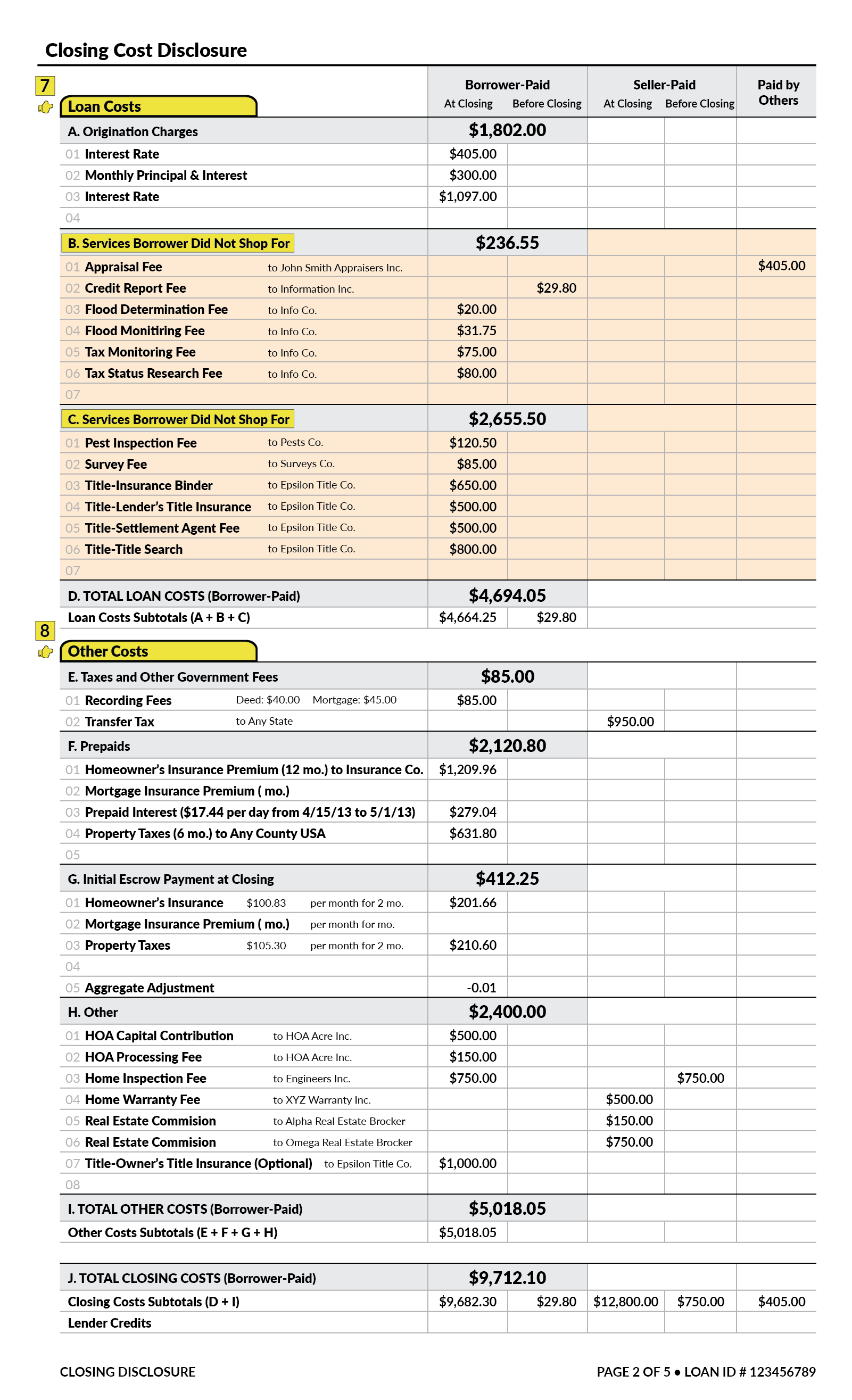

What Is A Closing Disclosure Lendingtree

What Is A Closing Disclosure Lendingtree

Truth In Lending Act Tila Consumer Rights Protections

Misspap On Instagram Credit Thefemalewarhol Misspapped Misspap Quote Aesthetic Words Quotes Words

Federal Register Truth In Lending Regulation Z

:max_bytes(150000):strip_icc()/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

Understanding Finance Charges For Closed End Credit

Federal Register Duties Of Creditors Regarding Risk Based Pricing Rule

Closing Credit Cards How To Credit Score Impact

What Is A Closing Disclosure Lendingtree

Federal Register Truth In Lending Regulation Z

What Is A Closing Disclosure Lendingtree

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-597314925-72053ed3e7d54bcca2b40d3d84937d67.jpg)

/GettyImages-520885672-a69470168f764663a37e873e291c8b37.jpg)